5 Factors that make up your credit score

Credit scores surprise many people who assume that if they never miss a payment, their FICO must be good. But your credit score is more than just your payment history. It takes 5 factors to create a credit score:

- Payment history

- Credit utilization (amounts owed and number of accounts)

- Credit mix

- New credit

- Length of credit history

Within those categories, there are dozens of “reason” codes that get a bit more specific, telling you which factors on your report had the most effect on making it less than perfect.

Good is good enough in most cases

As you read, remember there are differences between FICO scores and Vantage 3.0. This article is about FICO scores, which is what 90 percent of creditors use to underwrite credit applications.

Related: Where do free credit scores come from?

These factors are broken down by percentage according to their importance, with some more heavily affecting your FICO score than others.

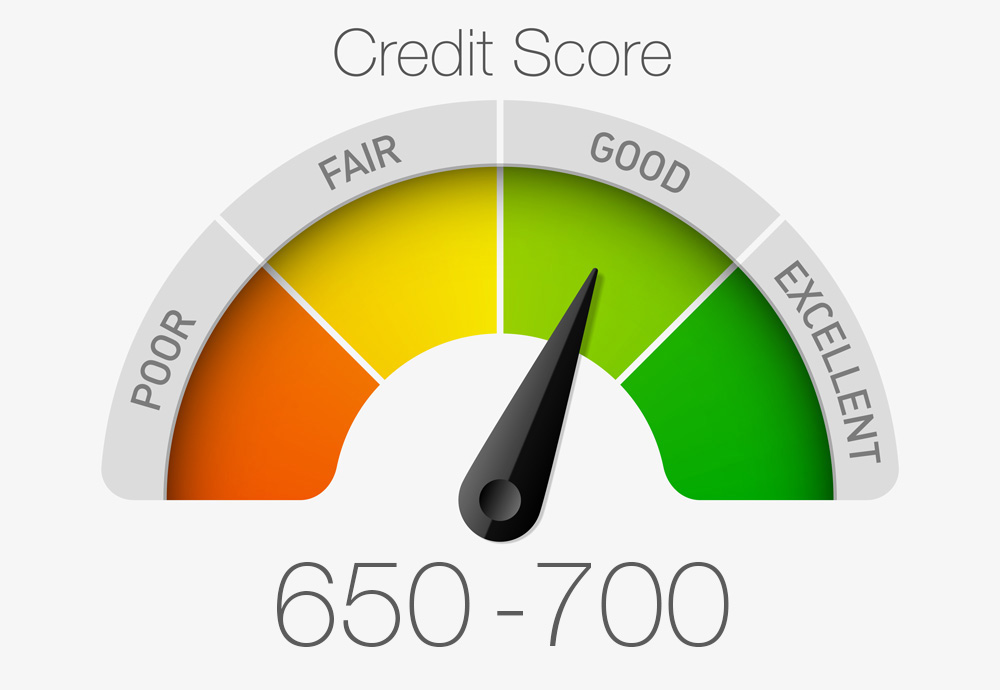

The lowest FICO score possible is 300, and the maximum achievable FICO score is 850. Lenders consider scores between 670 to 739 “good.” It’s also where most Americans fall on the FICO scale.

The average FICO score hit 700 in 2017, but that average also depends on your age — average FICO scores are higher for older Americans than younger adults. It takes time to develop a stellar FICO score, so keep that in mind when you’re comparing your scores to others.

Your payment history is the top factor

Creditors want you to repay your debt on time and in full, and other creditors watch how you pay your bills. That’s why FICO gives your payment history the most weight—35 percent—in its scoring model.

Payments 30 days or more days past due, charge-offs, collections, repossessions, foreclosures, and bankruptcies severely damage your credit score. Missing a single payment can take 60 to 120 points off your FICO score.

So, if you’ve kept your bills paid on time and don’t have any of these negative entries on your credit report, you’re helping keep your score high.

Use your credit wisely

Credit utilization (the percentage of available credit that you’re using) makes up 30 percent of your credit score. That means if you max out your credit cards or even come close, your credit score goes down significantly. It’s smart to keep credit utilization under 30 percent of your total available credit to maintain the best FICO score.

FICO measures credit utilization across all the types of debt you hold and breaks it down into sub-components this way:

- The amount of debt you still owe all lenders

- The number of accounts with outstanding debt

- The amount of you owe on individual accounts

- In some cases, the lack of certain loan types

- The percentage of revolving accounts, like credit cards

- The percentage of debt you still owe on installment loans, like mortgages

Changing balances on your credit cards or retail accounts can swiftly raise or drop your credit score. That doesn’t mean you never use your cards. If you don’t, creditors can’t determine how wisely you’ll manage available credit. Some credit card carriers will close your account if you leave the card inactive, lowing your credit score.

Don’t use up all your available credit if you can avoid it, because the more debt you owe, the riskier you look to creditors. Carrying balances and maxing out your credit indicates that you are spending more than you’re bringing in, which is unsustainable.

Mix up your credit strategically

The types of credit you have make a difference in how you get scored by FICO, too. It comprises 10 percent of your credit score. Having a single loan or credit card may not be enough to generate a credit score. In most cases, you need at least two or three “trade lines” to generate a credit score.

And creditors view you more favorably if you have a variety of debt types you manage well.

That means having more than one revolving account and a few types of installment credit like personal loans, mortgages and car notes. Having them all and keeping them paid on time makes you look more responsible to creditors.

But, that doesn’t mean you should overextend yourself by opening new credit accounts to get the credit mix right. Paying a few credit cards and an installment loan on time can give you the good credit score you need to get better rates on loans and credit cards.

In fact, since it’s at the bottom of the list of factors, you should focus on FICO score fundamentals like paying bills on time, keeping credit utilization low and opening new accounts only when you need them.

New credit can hurt more than help

Naturally, when you’re starting to build credit or you’re rebuilding your credit, you need new credit. Opening a few credit accounts for that purpose and responsibly handling them helps raise your credit score. But, opening too many accounts at a time leads to hard inquiries and creditor wariness, lowering your FICO score.

Related: Catch 22 (You need credit to get credit)

When you give a creditor your entire social security number and they “pull” your credit report and score from a credit reporting agency, that’s called a “hard” inquiry and can drop your score temporarily and can drop your score about 5 points. The more of those you have on your credit report, the lower your score and the riskier you appear.

That’s because if lenders see too many of those, especially in a short period, they suspect you’re in financial trouble and getting credit to fix it. Opening new accounts to use for “retail therapy” also makes you look like a lousy risk to creditors.

Credit longevity is a good look

Many things don’t age well, but your credit can, and the length of your credit history counts in FICO scoring. The longer you can show creditors you’ve managed credit responsibly, the better you look to them. FICO makes that 15 percent of your credit score. Understanding how FICO views the age of credit account is essential.

It’s a myth that FICO strikes a credit account from your credit history when it gets closed. FICO treats closed accounts the same as it does open ones in its scoring model. So, if you opened your first credit account 25 years ago, that’s how old your credit history is to FICO.

That means while there’s a right way to close credit accounts to avoid damaging your FICO score, closing them won’t reduce the length of your credit history with FICO.

The reasoning behind reason codes

Whenever you get denied credit, creditors have to provide you with a reason code that distinctly identifies why. In those cases, you’ll get an “adverse action” letter that tells you which credit reporting agency report they used and what in that report got you denied. What you see depends on which FICO score the creditor used.

Here are the five most common you’ll see on your credit report.

Delinquent accounts or derogatory public records. That means you have accounts with payments more than 30 days past due, collection accounts or a bankruptcy, judgment or tax lien on your credit record.

The latter three all are public records generated by courts or government agencies. Paying them off doesn’t always help, either. If recent enough, they still can adversely affect your FICO score.

Lack of recent loan/account information. This one is about not using your credit cards or not have certain credit types in our credit history. If your credit mix or age isn’t right to creditors, you’ll see this on the adverse action letter you receive.

Amount owed on accounts is too high. Creditors cite this as the reason for denying credit when you have a high credit utilization ratio. Using too much credit means you’ll probably see this reason code on your denial letter.

Length of time accounts have been established. Simply put, when it comes to your credit, age is more than a number. You don’t have a long enough credit history for creditors to see you as credit-worthy. That’s why you’ll see this on that adverse action letter they send you.

Too many accounts or inquiries. Opening too many accounts in a short time frame will show too many recent hard inquiries on your credit report. What constitutes a short time span varies by the creditor making the decision. Hard inquiries knock your score down and will be why you get denied credit in some cases.

Knowing what factors into your credit score will help you make decisions about credit use differently. Using this information wisely will help you get higher FICO scores, which makes getting cheaper credit easier.

Article by Dahna Chandler of The Mortgage Reports Contributor dated June 13th, 2018